On February 21, the Tax Law Society hosted our first annual Tax Return Workshop with a presentation by 2016-2017 Secretary Kerrington Hall. She covered a range of key information for students as they work on filing taxes and take advantage of every credit option:

- Filing Requirements

- Logistics (deadlines, forms)

- Amending options – learn about a credit later? Here’s how to take advantage!

- Scholarships & Fellowships

- Education Expenses

- American Opportunity Credit (formerly Hope Scholarship Credit)

- Lifetime Learning Credit

- Deducting Tuition & Fees

- Deducting Student Loan interest

- Smart choices: no double benefits

- Veterans’ Benefits

- More – including tools for International Students (see links in slides below)

Slides:

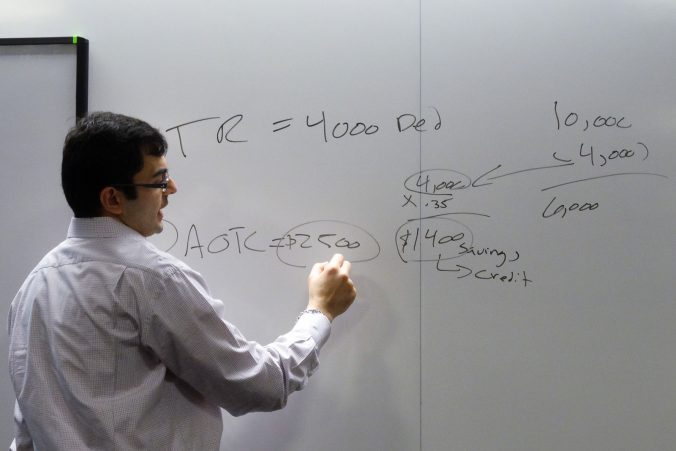

Photos:

- Kerrington Hall presenting

- evaluating the advantages of different tax options for students

Leave a Reply