Our Tax Law Society’s Founding President Jun Qiu joined a talk with ABA Legal Career Central and Kelly Phillips Erb, a tax attorney, teacher, writer, and Senior Editor for Forbes, at #LegalCareerChat on Monday, April 10.

Kelly received her JD and LL.M in Taxation from Temple University School of Law in Philadelphia and started blogging about tax law on www.taxgirl.com. Since then, she has written on tax law for Reuters, Time, and AOL’s WalletPop, and her ability to explain taxes in plain English was tapped by Esquire, National Public Radio’s Marketplace, CBS Radio’s Marketwatch, Inc., and the Philadelphia Inquirer. She was interviewed in a documentary movie, An Inconvenient Tax, and has written two books: Ask the TaxGirl: Everything Parents Should Know About Filing Taxes and Home, Sweet Rental: Busting The Hype Of Homeownership, together with Forbes where she is now a Senior Editor.

The one-hour talk covered Kelly’s career path, useful skills to learn and develop, good way to use social media, etc. See below for the conversation transcript and how our society’s name got out there!

View the story “#LegalCareerChat talks tax law” on Storify

Congratulations to Tax Law Society being one of the three organizations nominated for the Student Organization of the Year of this 2016-2017 academic year!

It’s exciting and encouraging to be selected out of over 40 student organizations at Chicago-Kent College of Law. Tax Law Society has been active since founded six months ago. As a well-known and well-liked student organization at school, and being recognized and appreciated by alumni and employers, Tax Law Society wants to thank all the executive board leaders, members, and supporters! It has been a great year with you!

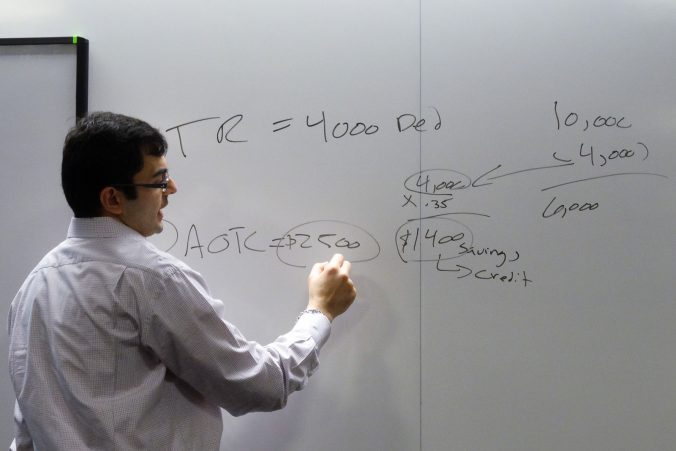

On February 21, the Tax Law Society hosted our first annual Tax Return Workshop with a presentation by 2016-2017 Secretary Kerrington Hall. She covered a range of key information for students as they work on filing taxes and take advantage of every credit option:

- Filing Requirements

- Logistics (deadlines, forms)

- Amending options – learn about a credit later? Here’s how to take advantage!

- Scholarships & Fellowships

- Education Expenses

- American Opportunity Credit (formerly Hope Scholarship Credit)

- Lifetime Learning Credit

- Deducting Tuition & Fees

- Deducting Student Loan interest

- Smart choices: no double benefits

- Veterans’ Benefits

- More – including tools for International Students (see links in slides below)

Slides:

Download (PPTX, 505KB)

Photos:

-

-

Kerrington Hall presenting

-

-

evaluating the advantages of different tax options for students

-